Top 5 Accounting Mistakes That Lead to Penalties in the UAE – 2025 Guide

Top 5 Accounting Mistakes That Lead to Penalties in the UAE In the evolving regulatory landscape of the UAE, businesses must remain vigilant when it

Home » When to Be Ready for DMCC Audit in the UAE for the Year 2021

According to the implementing regulations, a DMCC Member Company has to upload the auditor’s signed and stamped Audited Financial Statements Summary Sheet and the Audited Financial Statements Report via a designated online service request on the member portal within 90 days after the end of each financial year.

As per the Approved Auditors Rules (AAR) issued on 12th January 2017, it is the responsibility of each DMCC member company to ensure that their appointed auditor is registered as an Approved Auditor with DMCCA and is listed in the Approved Auditors List (AAL).

Original documents should be well maintained with the company and made available upon request by the DMCC Inspection Team. Submission of Audited Financials is applicable to all DMCC companies including subsidiaries and branch companies.

DMCC Authority reserves the right to request additional documents at any stage of the process as well as to request the original documents during the inspection.

1. Members are requested to advise their auditors to download the template “Company Audited Financial Statements Summary Sheet”, which can be found at www.dmcc.ae/managing-a- company > Compliance Services > Company Audited Financial Statements Summary Sheet.

2. The auditor will then need to complete, sign and stamp the Company Audited Financial Statements Report Summary Sheet and print it on the auditor’s letterhead along with the Audited Financial Statements report.

3. Once members have the two documents prepared, signed and stamped by the auditor, they will need to log on their portal and go to Company Services, then click on Compliance Services, where they will need to create a service request titled “Submit Company Audited Financial Statements Summary Sheet and Report”.

4. Members are requested to fill out the fields by entering the numbers and details as stated in the “Company Audited Financial Statements Summary Sheet”.

5. Members are requested to tick the declaration box to confirm that the information provided is true and correct; noting that it is an offense to enter false information. Then, click “Save”.

6. Members are required to update the Auditors Details by choosing the Listed Auditor Name from the drop-down list.

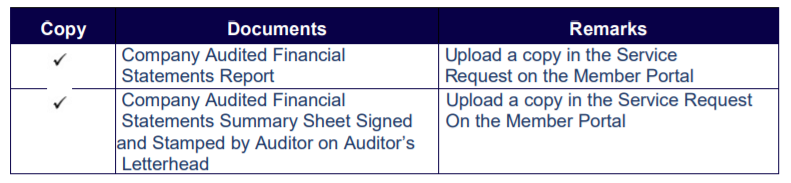

7. Members will then need to upload the following two documents and then, press “Submit”.

• Audited Financial Statements Report (Only copy is required)

• Audited Financial Statements Summary Sheet (Only copy is required)

Note: The original Company Audited Financial Statements Summary Sheet should be kept safely in the company’s possession and made available upon request by the DMCC Inspection Team.

If your business in DMCC/JLT Dubai and is looking to understand more about the taxes in the country and conduct an audit for your company, then you can take the assistance of Alya Auditors– Chartered Accountants. Alya is a reputed name in the field of Auditing and Accounting and is also a certified firm in almost all the free zones in the UAE including DMCC, DWC, DWTC. We will assess all the needs and requirements of the company and accordingly provide a solution.

For any more details on the services provided by Alya Auditors -Chartered Accountants, feel free to Contact Us. We will be happy to help.

Top 5 Accounting Mistakes That Lead to Penalties in the UAE In the evolving regulatory landscape of the UAE, businesses must remain vigilant when it

🛑 ⏳ 31 July 2025 – Last Chance to Avoid AED 10,000 Corporate Tax Penalty in the UAE! 📢 URGENT: 31 July 2025 is Your

Top Audit Firms in Dubai 2025 | Best Audit Companies in the UAE As the UAE’s regulatory landscape evolves, choosing the right audit firm in

Truly, let us know what service you are looking for and hence we can get back to you with more details.

Silver Tower, Business Bay. PO Box: 41102, Dubai, UAE.

Sharjah Airport Free Zone PO Box: 120403 Sharjah, UAE.

+971 48769377

+971 52 9750690 , +971 50 522 1035

Mon – Fri : 8:30 AM – 6 PM

Saturday – 9 AM – 5 PM

Sunday – Closed

© Alya Auditors 2022 All Rights Reserved