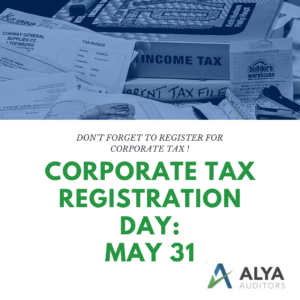

Corporate Tax Registration Deadline Alert

Corporate Tax Registration Deadline Alert If your business license was issued in August or September (any year), make sure to register for Corporate Tax by

Home » What are the Economic Substance Regulations (“ESR”) and why did the UAE government enact them?

ESR have been introduced in countries with low or no corporate taxes, in order to comply with international initiatives to combat harmful tax practices including unlawful avoidance or evasion. ESR requires certain legal entities to demonstrate that they carry out substantial economic activities in these jurisdictions, in accordance with the Economic Substance Test.

The UAE introduced the Economic Substance Regulations, applicable in free zones as well as on-shore, to honour its commitment as a member of the OECD Inclusive Framework on Base Erosion and Profit Shifting (“BEPS”), and in response to a review of the UAE tax reporting framework by the European Union (EU). The purpose of the Regulations is to ensure that UAE entities undertaking certain activities report actual profits that are commensurate with the economic activity undertaken within the UAE.

The UAE Economic Substance Regulations came into force on 30 April 2019, and subsequent guidance on the regulations was issued on 11 September 2019. Regulatory Authorities responsible for administering the ESR were identified in a Ministerial Resolution issued on 4 September 2019. Amendments were made to the ESR in Cabinet Decree No. 7 of 2020, which was issued on 19 January 2020. The Ministry of Finance is working with the OECD to further refine the scope and applicability of the UAE Economic Substance Regulations. Updates will be posted on this website and on the Ministry’s website.

The Economic Substance Test requires a Company in the UAE to demonstrate that:

Only UAE entities that have been dissolved, struck-off or liquidated prior to the deadline for submission of the Notification, are not required to file a Notification.

All other entities are required to file Economic Substance Notification, including those that are currently in the process of dissolution / liquidation.

No, each UAE entity must file a Notification on a stand-alone basis, irrespective of whether the entity is part of a consolidated group, for accounting purposes.

Intentionally or knowingly providing incorrect or false information in the Economic Substance Notification is subject to a fine of up to US$50,000 from the Registrar for breach of Article 66(2) of the Operating Law for concealing information or providing false or misleading information, as well as penalties ranging from AED 10,000 to AED 50,000 under the UAE Economic Substance Regulations. In addition, knowingly providing incorrect or false information or incorrectly claiming an exemption from the Economic Substance Regulations can result in the UAE entity being deemed to have failed the economic substance test for the relevant accounting period.

1. Penalty for first year:

(a) AED10, 000 – AED50, 000; and

(b) information exchange with foreign competent authority of:

(i) Parent company;

(ii) Ultimate parent company; and

(iii) Ultimate beneficial owner

2. Penalty for second consecutive year of failure:

(a) information exchange (see 1(b) above);

(b) penalty of AED100, 000 – AED300, 000; and commercial license could be: suspended, withdrawn or not renewed

With respect to the filing of the first Notifications under the Regulations by 30 June 2020, only DIFC entities that conduct a relevant activity and have a reportable period that ends on or before 31 December 2019 are subject to the fine for failure to file a Notification. For DIFC entities with a financial year that ends after 31 December 2019 (e.g. a financial year ending 31 March 2020 or 30 June 2020), there is no statutory requirement under the UAE Economic Substance Regulations to file a Notification by 30 June 2020, and accordingly no administrative penalties will apply under these Regulations for such entities, if a Notification is not submitted by the 30 June 2020 deadline. While the Registrar will not issue fines for firms with a financial year ending after 31 December 2019 that fail to file a Notification by 30 June 2020, the Registrar strongly encourages all entities to file a Notification to ensure that all UAE firms comply with the Economic Substance Regulations. The Registrar recognises that firms with a financial year that ends after 31 December 2019 may not have completed their financial year and therefore these firms will be able to file a further Notification, after the end of their financial year. Accordingly, the Registrar will communicate the deadline for filing a further Notification for reportable periods ending after 31 December 2019, during the second half of this year.

Our experts will conduct a preliminary check on your business on the applicability of Economic Substance Regulation.

For Assessment on Economic Substance Regulations in UAE

Corporate Tax Registration Deadline Alert If your business license was issued in August or September (any year), make sure to register for Corporate Tax by

Is it mandatory to register for corporate tax in UAE? All taxable persons are required to register for UAE Corporate Tax and obtain a Corporate Tax

Scope of UAE Corporate Tax: What You Need to Know The upcoming UAE Corporate Tax (CT) will impact a broad spectrum of businesses and individuals.

Navigating Crypto Auditing in the UAE: Ensuring Compliance and Security in the Digital Age Crypto auditing in the UAE is becoming increasingly critical as the

Get Note on the Crucial Documents for UAE Corporate Tax Registration Transitioning seamlessly into compliance, businesses and qualifying free zone persons in the UAE are

Truly, let us know what service you are looking for and hence we can get back to you with more details.

Silver Tower, Business Bay. PO Box: 41102, Dubai, UAE.

Sharjah Airport Free Zone PO Box: 120403 Sharjah, UAE.

+971 48769377

+971 52 9750690 , +971 50 522 1035

Mon – Fri : 8:30 AM – 6 PM

Saturday – 9 AM – 5 PM

Sunday – Closed

© Alya Auditors 2022 All Rights Reserved