UAE Corporate Tax: Key Dates, Penalties, Exemptions, and Essential Information

A standard statutory rate of 9 per cent took effect from the financial year beginning on or after June 1 last year

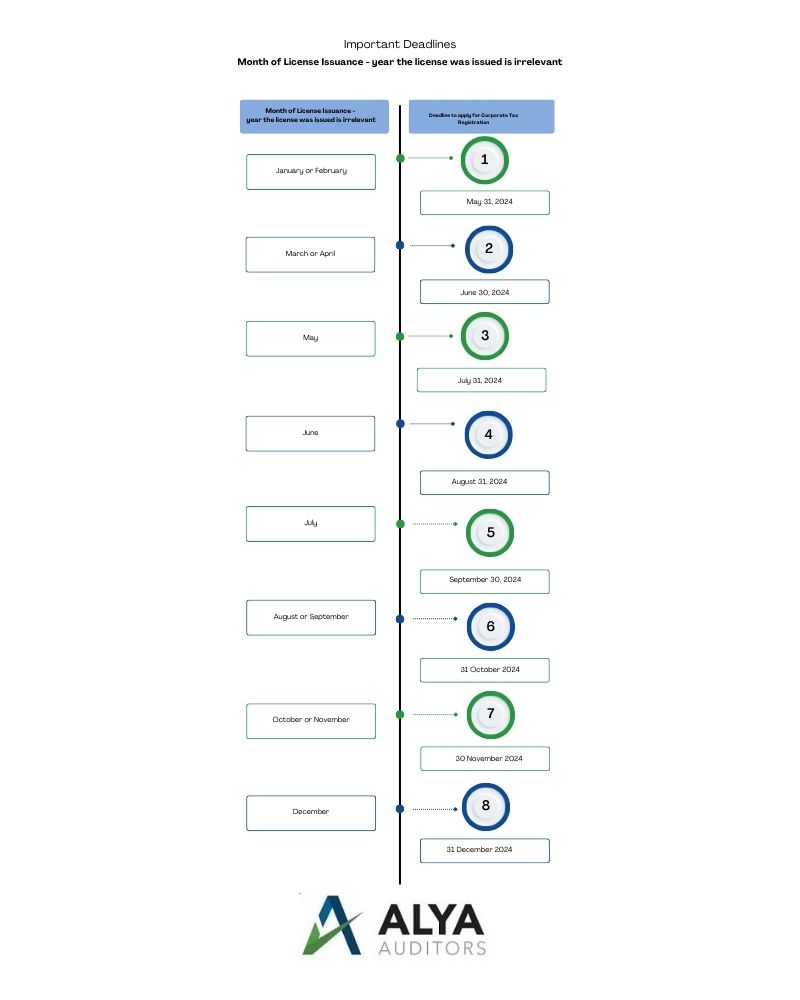

The UAE has announced new corporate tax registration deadlines for eligible businesses this year. Under a new decision that takes effect on March 1, businesses must register by a specified date based on the month their license was issued. Failure to comply will result in a fine of Dh10,000 ($2,722).

New deadlines

Under the decision announced by the Federal Tax Authority (FTA), resident companies incorporated or established in the UAE before March 1 must adhere to specific registration deadlines this year. For instance, if a license was issued in January or February, regardless of the year, the business must submit its corporate tax registration application no later than May 31 to comply with the law. Moreover, if a business holds multiple licenses, such as a group with several operations, the deadline is determined by the earliest issued license to establish the maximum timeframe, according to the FTA.

Important Deadlines: Corporate Tax Registration for UAE Companies Established Before March 1

Businesses established on or after March 1, including those in free zones, must register for corporate tax within three months of their incorporation, establishment, or recognition. Furthermore, a company established overseas but now managed and controlled in the UAE on or after March 1 must apply to register for corporate tax within three months of the end of their financial year.

Additionally, companies established overseas but operating in the UAE before March this year must apply to register for corporate tax within nine months of the date they started operations in the Emirates. In contrast, an overseas-based company doing business in the UAE must apply to register by May 31.

Lastly, an overseas company relocating to the UAE that begins operating on or after March 1 must apply to register for corporate tax within six months.

What is the tax rate?

The UAE introduced the federal corporate tax with a standard statutory rate of 9 percent, starting from the financial year beginning on or after June 1, 2023. This tax applies to companies with incomes exceeding Dh375,000 ($102,110), bringing them into the taxable bracket, while taxable profits below that level will be subject to a tax of zero percent.

In May, the Ministry of Finance confirmed that business owners in the country would be subject to corporate tax only if their turnover in a calendar year exceeds Dh1 million. This ensures that only business or business-related activity income is taxed.

For instance, a business owner or entrepreneur making Dh500,000 from their business in a calendar year would not pay tax on their earnings. Conversely, if a UAE resident operates an online business and the combined annual turnover from the business exceeds Dh1 million, that income would be subject to corporate tax under the new decision.

However, income from rental properties and personal investments would not be subject to the tax, as these sources of income fall under out-of-scope categories, according to the ministry.

How to register?

UAE businesses subject to corporate tax are required to register and obtain a tax registration number. Generally, the registration application must be submitted to the Federal Tax Authority (FTA). Additionally, taxable businesses must file a tax return with the FTA no later than nine months after the end of their financial year.

Furthermore, parent companies of tax groups should file a single tax return on behalf of the entire group. The FTA may also request certain exempt persons to register for corporate tax.

Who is exempt?

Several exemptions are offered for businesses operating in strategic sectors.

Those exempt from corporate tax include government entities, government-controlled entities, extractive and non-extractive natural resource businesses, qualifying public benefit entities and qualifying investment funds, public pension or social security funds, or private pension or social security funds.

Also exempt is an entity that is wholly owned and controlled by an exempt person if it undertakes part or all of the activity of the person, exclusively holds assets or invests funds for the benefit of the person, and only carries out activities that are ancillary to those carried out by the person.

In May, the UAE Ministry of Finance issued three new ministerial decisions that explain exemptions and the preparation of financial statements.

In April, the ministry also clarified that small businesses in the UAE with revenue of Dh3 million or less can benefit from a new corporate tax relief programme.

Penalty on Non Registration and Late Registration of Corporate Tax

The purpose of the penalty was to incentivize taxpayers to adhere to tax laws and timely register. The excise tax and value added tax penalties for late registration are correlated with the penalty amount for late tax registration.

Cabinet Decision of 2024, which was made public on 27th February 2024, the Cabinet Decision of 2023’s schedule of infractions and administrative fines.

The latter detailed the administrative penalties that would be levied for infractions pertaining to the execution of the Corporate Tax Law by the Federal Tax Authority (FTA). These fines become operative on August 1, 2023. On March 1, 2024, the Cabinet decision will take effect. Hence, an administrative penalty of Dh 10,000 will be imposed for late corporate tax registration on businesses that don’t submit the corporate tax applications within the due date directed by the Federal Tax Authority.

How Alya Auditors can help

If your company needs to manage financial transactions, procedures, reports, and more, Coming to Alya Auditors is the ideal solution.

We provide you all sort of help in handing your company’s expanding requirements. Along with many other capabilities, our team offers complete support for UAE VAT, from creating tax invoices to accurately completing VAT reports.

- Helping you create quick company reports that assist with calculating corporation tax, including accounting, inventory, and financial statements like balance sheets and profit and loss accounts

- Helping you finishing VAT returns quickly, accurately, and consistently

- Our team can help you in preparing invoices that adhere to VAT regulations while overseeing various VAT supply categories, including imports and exports

- Our expert technical teammates help your company maintain your accounting records with excellent accuracy and consistency.

total adaptability to various sales and buying procedures.