Is it mandatory to register for corporate tax in UAE?

Is it mandatory to register for corporate tax in UAE? All taxable persons are required to register for UAE Corporate Tax and obtain a Corporate Tax

Home » Tax Residency Certificate in Dubai,UAE

The UAE does not levy income tax on individuals. However, it levies corporate tax on oil companies and foreign banks. Excise tax is levied on specific goods which are typically harmful to human health or the environment. Value Added Tax is levied on a majority of goods and services.

The UAE government implemented value added tax (VAT) in the country from January 1, 2018 at a standard rate of 5%

In an era of globalization, businesses are no longer restricted to a single geographical territory and are spread across the globe. As total income is contributed by different countries, each country wishes to tax the global income of its residents and the profits earned on its land. In order to curb double taxation and ensure that the business owners are not paying tax for the same income twice, countries like UAE have entered into Double Tax Avoidance Agreement (DTAA). Once DTAA is signed between two countries, it mandates tax authority to produce a tax residence certificate, which helps investors, individual residents claim the treaty benefits.

The United Arab Emirates has 94 agreements in place with other countries to avoid double taxation on overseas investments.

Double taxation is defined when similar taxes are imposed in two countries on the same tax payer on the same tax base, which harmfully affects the exchange of goods, services and capital and technology transfer and trade across the border.

Public and private companies, investment firms, air transport firms and other companies operating in the UAE, as well as residents, benefit from Avoidance of Double Taxation Agreements (DTA). With the purpose of promoting its development goals, the UAE concluded 115 DTA to with most of its trade partners.

Promote the development goals of the UAE and diversify its sources of national income

Eliminating double taxation, additional taxes and indirect taxes and fiscal evasion

Remove the difficulties relating to cross-border trade and investment flows

Offer full protection to tax payers from double taxation, whether direct or indirect and avoid obstructing the free flow of trade and investment and promoting the development goals, in addition to diversify sources of national income and increase the size of investments inflows

Take into consideration the taxation issues and the global changes in the economic, financial sectors, and the new financial instruments and the mechanisms of transfer pricing

Encourage the exchange of goods, services and capital movements

Tax Residency Certificate in UAE is also known as “Tax Domicile Certificate”. It is issued by the UAE Ministry of Finance the governing body, to take advantage of the double taxation avoidance agreements signed between the foreign jurisdictions and the UAE. There are certain criteria to obtain Tax Residence Certificate in UAE, these are:

Corporate/Individual

The validity of a Tax Residence certificate is for 1 year.

Note: Dates can be chosen based on your requirement.

The process of issuing a tax residency certificate takes approximately 2 weeks to approve the application and up to 2 weeks for the delivery.

Alya Auditors has vast experience in offering professional tax planning and structuring services for international clients and also helps entrepreneurs and firms in starting a business in Dubai through company registration, incorporation and legal consulting services… We can help you with the following:

If you need any help with tax residency certificate, feel free to contact us. We’ll be glad to assist you.

Is it mandatory to register for corporate tax in UAE? All taxable persons are required to register for UAE Corporate Tax and obtain a Corporate Tax

Scope of UAE Corporate Tax: What You Need to Know The upcoming UAE Corporate Tax (CT) will impact a broad spectrum of businesses and individuals.

Navigating Crypto Auditing in the UAE: Ensuring Compliance and Security in the Digital Age Crypto auditing in the UAE is becoming increasingly critical as the

Get Note on the Crucial Documents for UAE Corporate Tax Registration Transitioning seamlessly into compliance, businesses and qualifying free zone persons in the UAE are

Top Audit firms in Dubai, UAE Alya Auditors Dubai stands as one of the Top 10 Accounting and Audit Firms in Dubai, UAE. In the

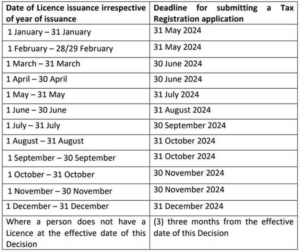

“Urgent Alert: UAE Corporate Tax Registration Deadlines Approaching Fast!” New FTA Update Establishes Precise Timelines Aligned with Businesses’ Licensing Month UAE businesses are urged to

Truly, let us know what service you are looking for and hence we can get back to you with more details.

Silver Tower, Business Bay. PO Box: 41102, Dubai, UAE.

Sharjah Airport Free Zone PO Box: 120403 Sharjah, UAE.

+971 48769377

+971 52 9750690 , +971 50 522 1035

Mon – Fri : 8:30 AM – 6 PM

Saturday – 9 AM – 5 PM

Sunday – Closed

© Alya Auditors 2022 All Rights Reserved