Corporate Tax Registration & Audit Services in UAE – Complete 2026 Guide for Businesses

Corporate Tax Registration & Audit Services in UAE – Complete 2026 Guide for Businesses With the implementation of Corporate Tax in the UAE, businesses must

Home » Tax invoice Format in the UAE

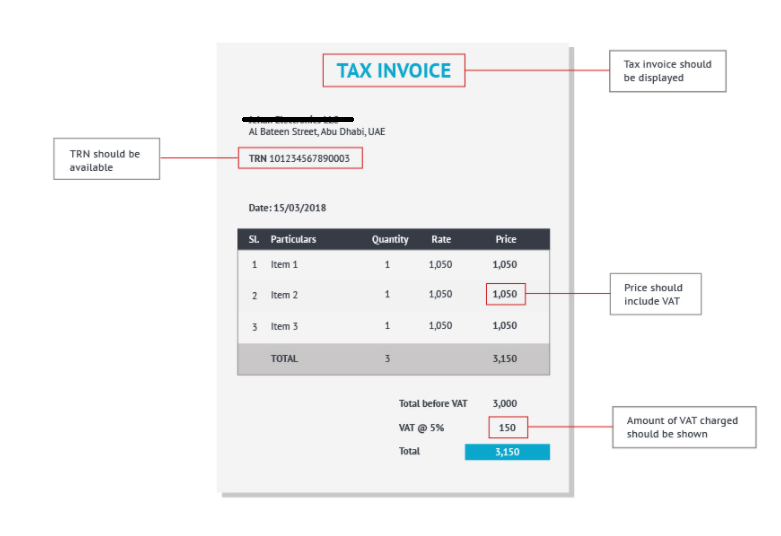

Tax Invoice is the essential document to be issued by a registrant when a taxable supply of goods or services is made. Under VAT in UAE, a Tax Invoice is to be issued by all registrants for taxable supplies to other registrants, where the consideration for the supplies exceeds AED 10,000. Hence, 2 conditions to be met for issuing a Tax Invoice are:

Most businesses in UAE, except retail businesses, would be dealing with supplies for which Tax Invoice is to be issued. As the mandatory details required in any Tax Invoice issued by registrants has been laid down in the VAT law, it is essential that all invoices issued under the VAT regime meet these requirements.

If Tax Invoices issued do not contain the required information, it could lead to an Administrative Penalty. In this regard, it would be useful for all businesses to use a software which would automatically pick the details required in a Tax Invoice, notify the user if any mandatory details are not given in the Tax Invoice, generate the Tax Invoice quickly and most importantly, keep updated about all the details that are required to be given in a Tax Invoice. Ensuring that Tax Invoices are issued correctly by suppliers is also important for the recipient of the supply.

The Tax Invoice serves as the basis on which the recipient can claim input tax deduction on the supply. Hence, businesses should take measures to ensure that Tax Invoices issued under VAT are accurate and complete

As a consumer in UAE, you are aware that VAT has been implemented in the country. You have also paid VAT on many purchases since then. However, there have been certain cases which have come to the fore now where suppliers have charged and collected VAT from consumers, though they are not authorized to do the same.

As consumers, it is understandable that our knowledge of the intricacies of the VAT Law will be limited. However, you do not need to worry. With this simple checklist, you can ensure that you are receiving a genuine Tax Invoice for your purchase.

This can be a basic checklist for you to ensure that you are paying VAT to genuine suppliers. This, along with the provision for any person to verify the validity of a TRN, gives great power in the hands of consumers to ensure that they are not cheated.

If your business in the UAE is looking to understand more about the taxes in the country and conduct a tax audit for your company, then you can take the assistance of Alya Auditors– Chartered Accountants. Alya is a reputed name in the field of Auditing and Accounting and is also a certified firm in the UAE which will assess the needs and requirements of the company and accordingly provide a solution.

For any more details on the services provided by Alya Auditors -Chartered Accountants, feel free to Contact Us. We will be happy to help.

Corporate Tax Registration & Audit Services in UAE – Complete 2026 Guide for Businesses With the implementation of Corporate Tax in the UAE, businesses must

How to Prepare for FTA Corporate Tax Audit in UAE (2026 Guide) With the implementation of Corporate Tax in the UAE, businesses must adopt a

UAE Tax Procedures Law Amendments Effective January 1, 2026: What Dubai Businesses Must Know 📌 Key Amendments Under Federal Decree-Law No. (17) of 2025 The

E-Invoicing in the UAE: The Complete Guide for Companies Introduction E-invoicing in the UAE is emerging as a critical component of the country’s digital tax