Is it mandatory to register for corporate tax in UAE?

Is it mandatory to register for corporate tax in UAE? All taxable persons are required to register for UAE Corporate Tax and obtain a Corporate Tax

Home » Latest update on the filing of Economic Substance Notification and Reporting in the UAE

The Ministry of Finance has introduced a completely new set of regulations and guidance, referred to as ‘Amended Regulations and Guidance’ in the UAE, with reference to the Economic Substance Regulations (ESR). This is to replace the former regulations that were originally introduced in April 2019. This New Guidance has provided several clarifications on the ESR requirements for entities in the UAE.

In accordance with Article 6.7 of Ministerial Decision 100 all Notifications and Economic Substance Reports shall going forward only be submitted electronically on the Ministry of Finance Portal. The Ministry of Finance portal is expected to become live by first week of December 2020.

Article 4.4 of Ministerial Decision 100 provides that all Notifications must be submitted within six months from the end of the Financial Year. The entities which has already submitted a Notification directly to their Regulatory Authorities are required to re-submit this Notification on the Ministry of Finance Portal once available. Article 8.4 of Decision 57 provides that all Economic Substance Reports must be submitted within twelve months from the end of the Financial Year.

The Ministry of Finance has provided clarification on resubmission of notification as per which the entities are required to filed by 31st December 2020.

Further the filing deadline for Economic Substance Reports for a Financial Year commencing on or after 1 January 2019 and ending on or before 31 December 2019 shall be 31 December 2020

The UAE introduced Economic Substance Regulations to honour the UAE’s commitment as a member of the OECD Inclusive Framework on Base Erosion and Profit Shifting (BEPS), and in response to a review of the UAE tax framework by the EU which resulted in the UAE being included on the EU list of non-cooperative jurisdictions for tax purposes (EU Blacklist). The issuance of the Economic Substance Regulations on 30 April 2019, and the release of Guidance on the application of the Regulations on 11 September 2019, was a requirement for the removal of the UAE from the EU Blacklist on 10 October 2019. In consultation with the OECD and the EU, amendments to the Regulations were made by Cabinet of Ministers Resolution No. (57) of 2020 on 10 August 2020 (the Regulations), and updated Guidance was issued on10 August 2020 (Ministerial Decision No. (100) of 2020 The Regulations ensure that UAE entities that undertake certain activities (Licensees – see Question [5]) are not used to artificially attract profits that are not commensurate with the economic activity undertaken in the UAE.

Economic Substance Regulation is applicable to all Licensee & Exempted Licensee carrying on the Relevant Activities in the UAE, including the Free Zone or Financial Free Zone; with effect from the year 2019.

The definition of “Licensees” which are required to comply with the New ESR now only applies to a corporate person (incorporated inside or outside of the UAE), or an unincorporated partnership – each having a presence in the UAE and conducting a Relevant Activity.

If you are a natural person, trust, sole proprietor, or foundation, you no longer fall within the scope of the definition.

These new exemption categories now include:

Majority government-owned entities are no longer exempt, unless they fall within one of the updated exemptions of the New ESR.

If you are a Licensee and wish to benefit from the exemption you will need to provide evidence that your entity qualifies for an exemption.

The New ESR recognises that UAE branches of a UAE company don’t have separate legal personalities from their parent or head office. Therefore, if you are a branch of a UAE parent entity and are registered in the UAE, you no longer need to file separate notifications. All that’s needed is a single notification concerning the Relevant Activities of your UAE parent company together with all your UAE branches.

If you are a UAE company that conducts a Relevant Activity only through a branch registered outside the UAE, your UAE company doesn’t need to report and demonstrate economic substance in situations where the income earned through the branch is taxed in the oversees jurisdiction where the branch is registered.

If you are a foreign company with a branch office registered in the UAE, then you don’t need to demonstrate economic substance under the New ESR, provided that the income earned by your branch’s activities, that would conceptually fall into a Relevant Activity category, is subject to tax in your overseas jurisdiction.

The UAE Federal Tax Authority has been appointed as the National Assessing Authority to oversee compliance and control of the New ESR.

The New ESR still includes several regulatory authorities’ responsibilities for receiving economic substance notifications, economic substance reports, and all supporting documents.

However, the new guidance suggests that if your business qualifies as a Licensee, you will have to file notifications with the UAE Ministry of Finance, via an online portal – which, as of this update, is still to be launched – within six months from the end of your financial year.

The penalties under the New ESR have been increased, including the administrative penalties for non-compliance, which are now between AED 20,000 and AED 50,000. If you fail to meet the economic substance test your business could incur a penalty of AED 50,000; you might also face the suspension or non-renewal of your license as additional penalties.

In the absence of updated filing deadlines, it appears that the deadline for economic substance reports for the 2019 financial year will remain 12 months after the end of the relevant financial year. If you’re a Licensee, this might be as early as 31 December 2020.

It’s important to note that all Licensees (including exempted Licensees) are required to file notifications on the new online portal once it’s available, regardless of whether they have already submitted notifications for the 2019 financial year under the old legislation.

If you are interested in a prosperous future from a personal and/or business standpoint, reach out to our team of dedicated professionals. When considering accounting, audits, tax or business consulting, one call can make all the difference. Click here to get started – we look forward to working with you!

Is it mandatory to register for corporate tax in UAE? All taxable persons are required to register for UAE Corporate Tax and obtain a Corporate Tax

Scope of UAE Corporate Tax: What You Need to Know The upcoming UAE Corporate Tax (CT) will impact a broad spectrum of businesses and individuals.

Navigating Crypto Auditing in the UAE: Ensuring Compliance and Security in the Digital Age Crypto auditing in the UAE is becoming increasingly critical as the

Get Note on the Crucial Documents for UAE Corporate Tax Registration Transitioning seamlessly into compliance, businesses and qualifying free zone persons in the UAE are

Top Audit firms in Dubai, UAE Alya Auditors Dubai stands as one of the Top 10 Accounting and Audit Firms in Dubai, UAE. In the

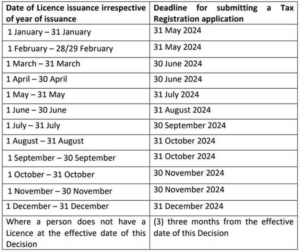

“Urgent Alert: UAE Corporate Tax Registration Deadlines Approaching Fast!” New FTA Update Establishes Precise Timelines Aligned with Businesses’ Licensing Month UAE businesses are urged to

Truly, let us know what service you are looking for and hence we can get back to you with more details.

Silver Tower, Business Bay. PO Box: 41102, Dubai, UAE.

Sharjah Airport Free Zone PO Box: 120403 Sharjah, UAE.

+971 48769377

+971 52 9750690 , +971 50 522 1035

Mon – Fri : 8:30 AM – 6 PM

Saturday – 9 AM – 5 PM

Sunday – Closed

© Alya Auditors 2022 All Rights Reserved