Is it mandatory to register for corporate tax in UAE?

Is it mandatory to register for corporate tax in UAE? All taxable persons are required to register for UAE Corporate Tax and obtain a Corporate Tax

Home » How to de-register under VAT in the UAE

Value Added Tax or VAT is a tax on the consumption or use of goods and services levied at each point of sale. VAT is a form of indirect tax and is levied in more than 180 countries around the world. The end-consumer ultimately bears the cost. Businesses collect and account for the tax on behalf of the government.

Value Added Tax (VAT) was introduced in the UAE on 1 January 2018. The rate of VAT is 5 per cent. VAT will provide the UAE with a new source of income which will be continued to be utilised to provide high-quality public services. It will also help government move towards its vision of reducing dependence on oil and other hydrocarbons as a source of revenue.

Tax De-registration is the provision for a registered taxable person to cancel his/her VAT registration. It means de-activation of the registration and the VAT number of the taxable person. Tax de-registration can be applied for by a person registered under VAT or done by the FTA on finding that a person meets the conditions for de-registration.

A person registered under VAT can apply for Tax De-registration in the following 2 cases:

Note that a person who has voluntarily registered under VAT cannot apply for de-registration in the 12 months following the date of registration.

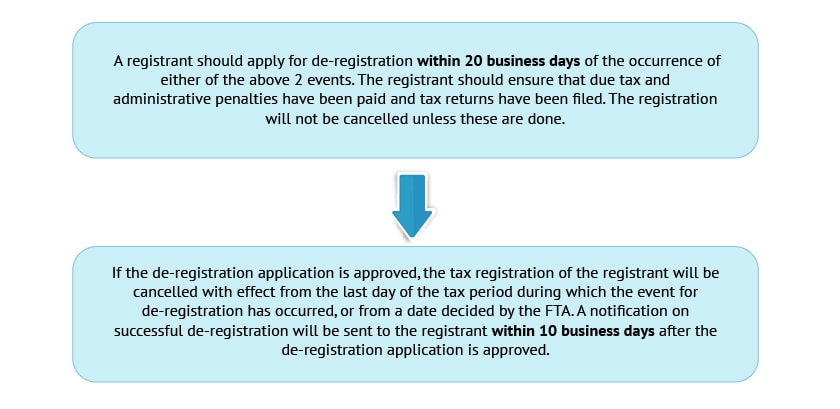

The process for de-registering under VAT is shown below:

The FTA can cancel a person’s registration if it is found that the registrant satisfies either of the 2 conditions listed above for de-registration. This is called mandatory tax de-registration.

Hence, VAT de-registration is a welcome option for persons who have registered under VAT but do not continue to make supplies requiring registration. Such persons do not need to continue being registrants and can apply for tax de-registration on satisfying the applicable conditions.

The FTA can cancel a person’s registration if it is found that the registrant satisfies either of the 2 conditions listed above for de-registration. This is called mandatory tax de-registration.

Hence, VAT de-registration is a welcome option for persons who have registered under VAT but do not continue to make supplies requiring registration. Such persons do not need to continue being registrants and can apply for tax de-registration on satisfying the applicable conditions.

First step is to Login to your Federal Tax Authority (FTA) online portal. On the home page, there will be an option of ‘De-Registration’. There will be a VAT Deregistration form, fill the form with the correct information and send it to the authorities in order to review and approve the VAT Deregistration.

After applying for the VAT Deregistration, FTA will review the application and if they confirm the VAT De-registration the status of VAT De-Registration will be changed to ‘Pre-Approved’. After that the businesses have to submit final VAT Return Filing, after the last VAT Return filing the businesses must clear all the outstanding liabilities in order to complete the VAT Deregistration process.

Alya Auditors have registered Tax Agents by FTA and will assist you by providing VAT Deregistration services in UAE. Alya will help your business to grow by avoiding any fines and penalties through providing the following services:

Let Alya Auditors handle all the complex issues regarding VAT in UAE. For more information regarding VAT De-Registration in UAE, feel free to contact us.

Is it mandatory to register for corporate tax in UAE? All taxable persons are required to register for UAE Corporate Tax and obtain a Corporate Tax

Scope of UAE Corporate Tax: What You Need to Know The upcoming UAE Corporate Tax (CT) will impact a broad spectrum of businesses and individuals.

Navigating Crypto Auditing in the UAE: Ensuring Compliance and Security in the Digital Age Crypto auditing in the UAE is becoming increasingly critical as the

Truly, let us know what service you are looking for and hence we can get back to you with more details.

Silver Tower, Business Bay. PO Box: 41102, Dubai, UAE.

Sharjah Airport Free Zone PO Box: 120403 Sharjah, UAE.

+971 48769377

+971 52 9750690 , +971 50 522 1035

Mon – Fri : 8:30 AM – 6 PM

Saturday – 9 AM – 5 PM

Sunday – Closed

© Alya Auditors 2022 All Rights Reserved