Top 5 Accounting Mistakes That Lead to Penalties in the UAE – 2025 Guide

Top 5 Accounting Mistakes That Lead to Penalties in the UAE In the evolving regulatory landscape of the UAE, businesses must remain vigilant when it

Home » Economic Substance Regulations Filing in the UAE

Economic substance rules were introduced in the United Arab Emirates (UAE) in April 2019, and businesses need to assess how they comply with those rules.

Economic substance regulations have recently been introduced across the globe in countries with no or nominal corporate tax rates in order to comply with international initiatives to combat harmful tax practices.

In essence the new rules require certain legal entities established in those countries to demonstrate that they carry out substantial economic activities there.

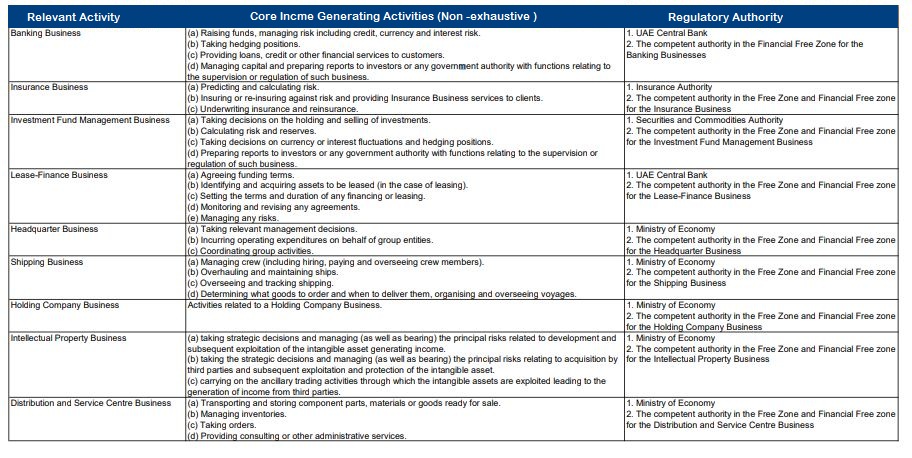

To satisfy the economic substance requirements in relation to a Relevant Activity, a Relevant Entity must:

● Conduct the relevant “core income generating activities” in the UAE;

● Be “directed and managed” in the UAE; and

● With reference to the level of activities performed in the UAE:

Substantial Activities under Economic Substance Regulations means the Companies get incorporated under the local law of the country but do not engage or conduct any activity or hold any substance in that country. Generally, such practices are done in “No or Nominal Tax jurisdictions” (called as NOON’s). Such Companies use NOON’s to park profits thereby harming the tax base of another jurisdiction.

Therefore, Forum of Harmful Tax Practices (FHTP) conducts reviews to check whether the practices of one jurisdiction is harmful to the tax base of another jurisdiction. One of the areas of FHTP is Substantial activity requirements. To prove the substance of the activities undertaken by Company in the Country is important to have a clear view and information on the amount of business conducted from that jurisdiction. This becomes important for such companies having their head office in country where the global income gets taxed. Hence it is necessary to prove the substance of the activities carried.

In cases where Companies are managed by Manager & CEO, the requirements shall apply to that concerned Manager or CEO. Also, the responsibility lies with the licensee to prove that the Manger or CEO has relevant knowledge and expertise to take decisions and merely acting on the decisions taken outside UAE.

iii. One of ESR test is to have adequate number of qualified employees to conduct licensee activities. Adequate number will depend on the nature and the size of Business of Companies. Again, the responsibility lies on the licensee to prove to the regulatory authority the genuineness of the activities with the available Employees, Operating Expenditure and Assets.

These requirements are to be satisfied to prove that the licensee holds substance and the business are genuine.

Details on what will be included in the State Core Income-generating Activities for the above mentioned 9 relevant activities will be followed in our future blog.

If your business falls under the entities with the above-mentioned activities in the UAE, then you may need assistance to determine the applicability if Economic Substance Regulations is relevant for you as you need to analyze the implication of this new regulation in the UAE.

The team at ALYA Auditors will assist you in making this determination; provide preliminary assessments of your company’s current compliance obligations, and assist with possible future strategies, in response to this new legislation.

For Economic Substance Regulations in the UAE

Top 5 Accounting Mistakes That Lead to Penalties in the UAE In the evolving regulatory landscape of the UAE, businesses must remain vigilant when it

🛑 ⏳ 31 July 2025 – Last Chance to Avoid AED 10,000 Corporate Tax Penalty in the UAE! 📢 URGENT: 31 July 2025 is Your

Top Audit Firms in Dubai 2025 | Best Audit Companies in the UAE As the UAE’s regulatory landscape evolves, choosing the right audit firm in

Truly, let us know what service you are looking for and hence we can get back to you with more details.

Silver Tower, Business Bay. PO Box: 41102, Dubai, UAE.

Sharjah Airport Free Zone PO Box: 120403 Sharjah, UAE.

+971 48769377

+971 52 9750690 , +971 50 522 1035

Mon – Fri : 8:30 AM – 6 PM

Saturday – 9 AM – 5 PM

Sunday – Closed

© Alya Auditors 2022 All Rights Reserved